This article aims to analyze how Filecoin Token enters the circular supply, provide more insights on how various stakeholders participate in its economy, and clarify how people should treat and think about Filecoin Token economics.

Part 1 Filecoin Ecosystem

The growth momentum in the Filecoin ecosystem is the main driving force for the use cases, tools, and infrastructure of all Filecoin stakeholders. Since the launch of the Filecoin mainnet on October 15, 2020, the network has surpassed several important milestones:

➊The storage capacity of more than 800 nodes in the network exceeds 1.38EiB

➋An ecosystem of more than 90 projects to build applications, developer tools and infrastructure on the web

➌More than 200 new projects entering the ecosystem through hackathons and accelerators

➍More than 5400 developers contributed to the GitHub repo of the project

➎Developed many use cases, including consumer storage applications, archive storage, DeFi, decentralized video, etc.

Part 2 Filecoin as a utility token

Filecoin is a utility token intended to be used, which gives token holders the right to use the network. One can think of Filecoin as an island economy where participants can gather to produce valuable storage products and services and export them to all parts of the world.

On the Internet, one should expect to see storage providers with their own unique characteristics, smart contract systems, lending services, various use cases, etc., which can all become their own unique businesses. The utility of the network is reflected in the attractiveness of the goods and services produced by the participants in the network.

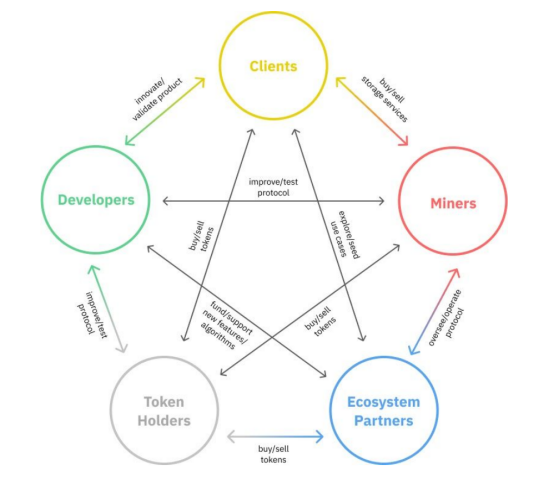

The overall goal of the entire economy spanning participants, developers, researchers, customers and Token holders is to efficiently produce fascinating storage-related goods and services and export them to the outside world. The economical and more efficient production of more valuable commodities will lead to more demand for commodities and more demand for network tokens. The increase in the purchasing power of participants in the economy will enable them to expand and improve their businesses, thereby providing better and cheaper services to the world.

Part 3 Token Mining

Match the Miner Minting curve with Network Utility.

As a utility token that aligns the incentives of participants with the long-term goals and vision of the network, Filecoin casting is consistent with the overall provable utility of the network. This means that most of the Filecoin supply will only be minted if the network achieves some ambitious growth and utility goals.

Unlike most other blockchain networks, Filecoin innovatively uses a double casting model: simple model and baseline model:

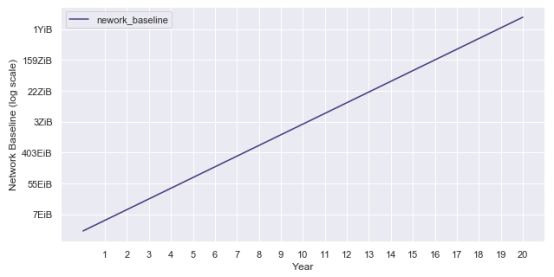

❶ Baseline mining: Up to 770M FIL (most storage mining allocation) is cast based on network performance. This is a powerful motivation for network cooperation to achieve the ultimate storage capacity goal of storing a large amount of the most important information of mankind. The full version of these tokens will only be released when the Filecoin network reaches Yottabyte’s storage capacity in less than 20 years.

According to some analysts, today’s data centers store less data than Zettabyte (despite rapid growth), so this goal is 1,000 times larger than today’s cloud storage estimates.

❷ Simple casting: release 330M FIL in a half-life of 6 years based on time. The 6-year half-life means that 97% of these tokens will be released in approximately 30 years. Cast this small but meaningful amount regardless of the agent’s actions to provide counter-pressure to the impact.

❸ Mining reserve: Reserve 300 million FIL to incentivize future mining types. It will be up to the community to decide how to release these tokens and which stakeholders should be motivated, but at present, this part of the total supply is retained.

In this way, effective token casting is in the hands of the community, falling between the two rows in Figure 1. Figure 2 shows how much the network needs to grow to reach the maximum casting volume. Although the community may gather to update the benchmarks of the network, to achieve the benchmarks requires competitive collaboration among all stakeholders, researchers, participants, developers, token holders, ecosystem partners, and storage customers .

Part 4 Token release

Token release should align stakeholders with long-term behavior. Another core principle and mechanism that encourages long-term consistency includes avoiding stakeholder affiliation, thereby encouraging participants to stay away from short-term guesswork, and encouraging all stakeholders to work together to make the Filecoin network more useful in the long-term.

This applies to every core stakeholder of Filecoin, including:

❶Mining rewards All mining rewards are released in some form to encourage long-term network adjustments. For example, 75% of the block reward obtained by a node can be released linearly within 180 days, and 25% can be obtained immediately to improve the node’s cash flow and profitability.

Of course, as described below, all rewards earned will be significantly reduced throughout the entire life cycle of the industry. Unreliable storage will reduce the usefulness of the network, so the block rewards obtained by these sectors will be reduced and burned.

❷ From the start of the network for SAFT investors, all SAFT holders will receive FIL with linear release terms for 6 months, 1 year, 2 years and 3 years. Most of the purchased SAFT Tokens will be released linearly within 3 years:

58% of SAFT Token will be released linearly within 3 years

5% of SAFTs Token will be released linearly within two years

15% of SAFTs Token will be released linearly within 1 year

22% of SAFTs Token will be released linearly within 6 months

❸The Filecoin Foundation will start on the mainnet, and the 100M FIL of the Filecoin Foundation will grow linearly within 6 years.

❺ Starting from the network release of the Protocol Lab, Protocol Labs’ 300M FIL can be linearly put into use within 6 years. When Protocol Labs encourages the development of the ecosystem through grants with important partners, these people usually also have more than 6 years of ownership.

These long-term release schedules for Token holders help ensure that participants are eligible to participate in the network and take a long-term view of their behavior on the network.

Part5 mortgage and reduction

Mortgages and cuts align participants with reliable storage. Blockchain networks such as Filecoin use rewards to incentivize good behavior and fines to punish bad behavior. The penalty (called a sharp cut) comes from the collateral that the participant must post, or the participant may have received a potential return. Filecoin has many such mechanisms to incentivize high-quality, reliable long-term storage.

From providing network storage capacity to meeting customers’ storage needs, nodes must freeze Filecoin Token to achieve consensus security, storage reliability, and contract guarantees. Fil is locked as pledged collateral to bring storage supply to the network, and needs to be used as transaction collateral and payment to meet storage needs.

Naturally, the number of Filecoin Tokens locked by collateral and drastically reduced due to improper behavior is in the hands of the community:

➊At the network level, the amount of locked collateral depends on the amount of storage capacity promised to the network and the circulating supply of the network at the time of promise. At the individual level, the pledged collateral is determined by the expected overall reward that the node will receive to ensure that the pledged collateral is not prohibitive. As long as there is storage on Filecoin, Fil will always be locked at any time.

➋All the amount of Fil used for transaction collateral and payment is the result of the joint efforts of all participants, the purpose is to make the storage goods and services on Filecoin more attractive.

➌Node’s collateral and all the rewards received will be greatly reduced throughout the entire life cycle of the industry. Unreliable storage reduces the usefulness of the network. Therefore, the block-like rewards obtained by these sectors will be reduced and consumed.

Part 6 Filecoin Plus

Filecoin Plus aligns participants with useful storage. Filecoin is a global market supported by blockchain technology. Since there is no reliable method to separate the actual useful data from the randomness generated by the algorithm, Filecoin Network innovatively and pragmatically introduces the social trust layer on top of the technical layer Filecoin Plus.

Filecoin Plus transfers power to storage clients, because nodes store transactions from these clients and are notarized by the network of notaries, thus gaining a 10 times advantage in storage capacity. Therefore, their share of network block transactions has also increased by 10 times. .

This mechanism incentivizes all participants for relevant business development, recruits useful data and use cases, and makes Filecoin more useful. When nodes get 10% of the overall reward share, they must also provide 10 times the collateral and 10 times the fine to ensure consistent incentives. This is also a major advancement in community governance and decentralized cryptoeconomics, because communities are shaping operations and processes in public.

Part 07 network transaction fees

Network transaction fee: adjust the Token supply according to the network usage. As long as there are any actions or utilities on the network, Filecoin Token will be used to compensate for the computing and storage resources consumed by messages on the chain. Similar to the rate at which nodes generate Fil, when participants compete for resources on the chain, the rate of token consumption is also in the hands of the community.

As of recently, the daily consumption of Filecoin has climbed to 180,000 Fijian dollars per day, which marks the booming economy.

Part 08 conclusion

The economic mechanism embedded in the Filecoin protocol ensures that network activities and stakeholders are fully consistent with the long-term health of the network. Variable mechanisms based on network growth, attribution structure, Fil consumption, collateral requirements, etc., as well as mechanisms that combine the incentives and motivations of participants with the long-term success of the network.

Making Web3 mainstream requires the efforts of all ecosystem participants. The incentives of the Filecoin protocol must balance the interests of all stakeholders, storage customers, vendors, developers, Token holders, and ecosystem partners.

The booming economy benefits everyone in the network and aligns long-term incentives for all participants. Most importantly, the future of Filecoin is in the hands of all its communities.